Start the Conversation With Westfield Standard Lines

To learn more about becoming an appointed agency, please complete our agency profile form. Here’s how it works:

Step 1

Step 2

Step 3

$3.2 Billion

in Direct Written Premium

$3 Million+

given annually through the Westfield Insurance Foundation

“A” rated (Excellent)

by AM Best since 1934

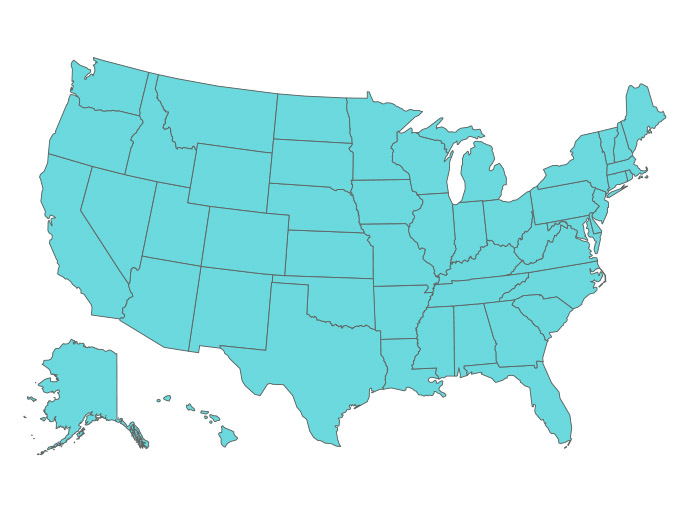

Where We Write Standard Lines of Business

Westfield provides personal insurance in 9 states, commercial insurance in 21 states, and surety products in 50 states. Explore our lines of business.

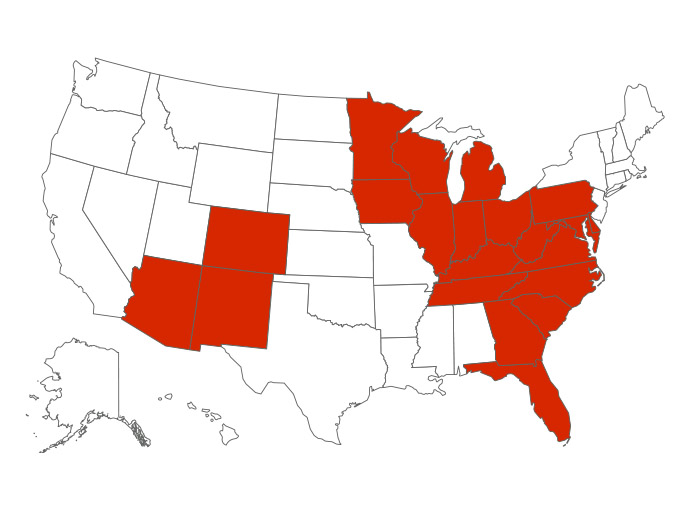

Small and Middle Market Commercial Business

Westfield offers business insurance in the following states: Arizona, Colorado, Delaware, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Maryland, Michigan, Minnesota, New Mexico, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Virginia, West Virginia, and Wisconsin.

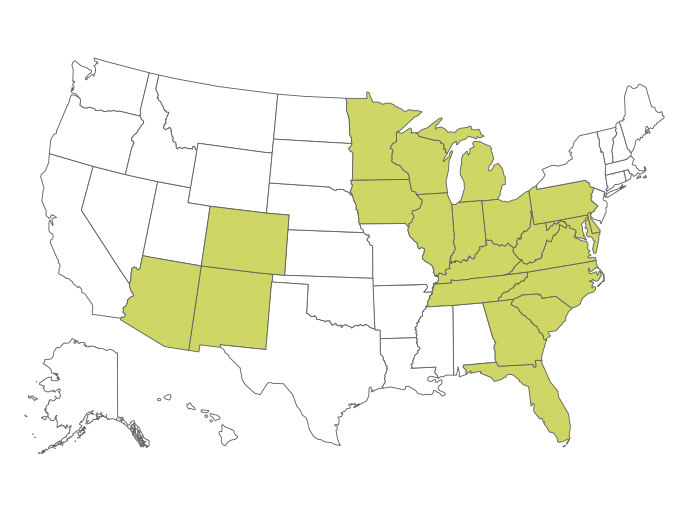

Farm and Agribusiness

Westfield offers farming and agribusiness insurance in the following states: Arizona, Colorado, Delaware, Florida (commercial agriculture insurance only), Georgia, Illinois, Indiana, Iowa, Kentucky, Maryland, Michigan, Minnesota, New Mexico, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Virginia, West Virginia, and Wisconsin.

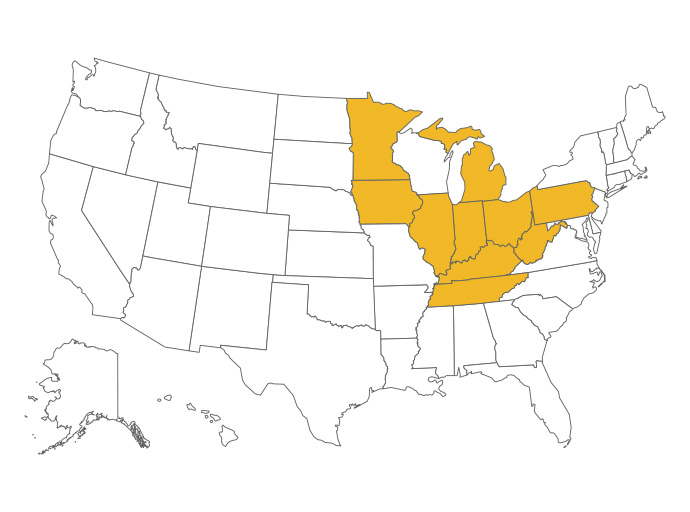

Personal Lines

Westfield offers home and auto insurance coverage in the following states: Indiana, Illinois, Kentucky, Ohio, Michigan, Minnesota, Pennsylvania, Tennessee, and West Virginia.

Surety Bonds

Westfield offers a broad range of surety bonds, including commercial and contract surety bonds, in all 50 states.